Small Business Insurance Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Property insurance, General liability insurance, Worker's compensation insurance, Others), By Application (Small-sized Enterprise, Medium-sized enterprise, Large-sized enterprise), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Small Business Insurance Market Report 2023-2030

Small Business Insurance Market Report is designed to incorporate both qualify qualitative and quantitative aspects of the industry with respect to each of the regions and countries involved in the study. This report also provides a balanced and detailed analysis of the ongoing Small Business Insurance trends, opportunities-high growth areas, Small Business Insurance market drivers which would help the investors to devise and align their market strategies according to the current and future market dynamics. The analysis includes Small Business Insurance Market size, situation, segmentation, price, and industry environment. In addition, the report outlines the factors driving industry growth and the description of market channels.

The report begins with an overview of the industry chain, structure and describes all segments. Besides, the report analyses market size and forecast in different geographies, types, and end-use segments, in addition, the report introduces a market competition overview among the major companies. The report also analyses industry trends, then analyses market size and forecast of Small Business Insurance by product, region, and application, in addition, this report introduces market competition situation among the vendors and company profile, besides, market price analysis and value chain features are covered in this report.

| Report Attributes | Report Details |

| Base Year | 2022 |

| Forecast year | 2023-2030 |

| Unit | Value (USD Million/Billion) | Segments Covered | Key Players, Types, Applications, End-Users, and more |

| Report Coverage | Total Revenue Forecast, Company Ranking and Market Share, Regional Competitive Landscape, Growth Factors, New Trends, Business Strategies, and more |

| Region Analysis | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Product Types | Property insurance, General liability insurance, Worker\'s compensation insurance, Others |

| End-user Industry | Small-sized Enterprise, Medium-sized enterprise, Large-sized enterprise |

| Major Players | CPIC, AIG, AXA, Allianz, Marsh USA Inc., Westfield, Allstate, Liberty Mutual, USAA, Liberty Mutual |

Global Small Business Insurance market size will increase to Million US$ by 2030, from Million US$ in 2022, at a CAGR of during the forecast period. In this study, 2023 has been considered as the base year and 2023 to 2030 as the forecast period to estimate the market size for Small Business Insurance

The report covers market size status and forecast, value chain analysis, market segmentation of Top countries in Major Regions, such as North America, Europe, Asia-Pacific, Latin America and Middle East & Africa, by type, application and marketing channel. In addition, the report focuses on the driving factors, restraints, opportunities and PEST analysis of major regions.

Global Small Business Insurance Market: Segmentation Analysis

Major companies in the market include:

CPIC

AIG

AXA

Allianz

Marsh USA Inc.

Westfield

Allstate

Liberty Mutual

USAA

Liberty Mutual

On the Basis of Type:

Property insurance

General liability insurance

Worker\'s compensation insurance

Others

On the Basis of Application:

Small-sized Enterprise

Medium-sized enterprise

Large-sized enterprise

Regional Analysis For Small Business Insurance Market

North America (the United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, and Italy)

Asia-Pacific (China, Japan, Korea, India, and Southeast Asia)

South America (Brazil, Argentina, Colombia, etc.)

The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa)

Our team of enthusiastic analysts, research experts, and experienced forecasters work precisely to produce such kind of market report. The research report defines USD values, CAGR (compound annual growth rate) values, and their variations for the precise projected time frame.

The sample pages for this report are readily available on demand.

Along with the market overview, which comprises of the market dynamics includes Porters Five Forces analysis which explains the five forces: namely buyers bargaining power, suppliers bargaining power, threat of new entrants, threat of substitutes, and degree of competition in the Global Small Business Insurance Market Size. It explains various participants such as system integrators, intermediaries and end-users within the ecosystem of the market. The report also focuses on the competitive landscape of the Global Small Business Insurance Market Size.

This report provides an all-inclusive environment of the analysis for the Global Small Business Insurance Market Size. The market estimates provided in the report are the result of in-depth secondary research, primary interviews and in-house expert reviews. These market estimates have been considered by studying the impact of various social, political and economic factors along with the current market dynamics affecting the Global Small Business Insurance Market Size growth.

Objectives of Research study:

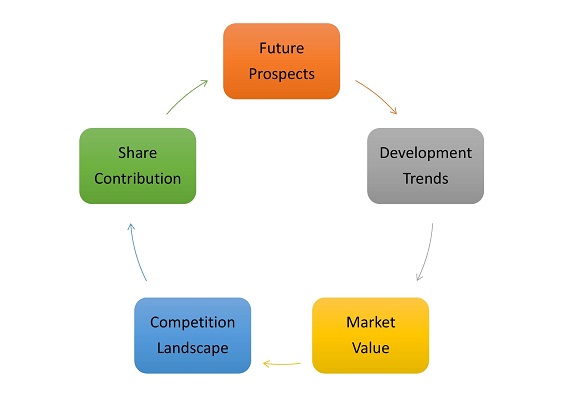

- To observe the industry with reverence to individual future prospects, development trends, and contribution to the overall market.

- The overview of the global Small Business Insurance market

- The report comprised of the market companies, to describe and define and analyze the Small Business Insurance market value, share competition landscape, development plans, and SWOT analysis.

- The report also involves the structure of the industry by identifying its several sub-segments.

The research information and studies associated with participant analysis keep the competitive landscape noticeably into the focus with which the market can select or advance their own policies to increase the market growth.

Key Questions Answered in This Report:

- How has the global Small Business Insurance market performed so far and how will it perform in the coming years?

- What are the key driving factors and challenges in the global Small Business Insurance market?

- What is the breakup of the global Small Business Insurance market on the basis of product type?

- What is the breakup of the global Small Business Insurance market on the basis of application?

- What are the key regional markets in the global Small Business Insurance industry?

- What is the structure of the global Small Business Insurance market and who are the key players?

- What has been the impact of COVID-19 on the global Small Business Insurance market?

- What are the various stages of growth strategies of the global Small Business Insurance market?

- What is the degree of competition in the global Small Business Insurance market?

- How are Small Business Insurance manufactured?

Small Business Insurance Market – Overview

1.1 Definitions, Overview, and Scope

1.2 Drivers, Restrain, Challenges, Opportunities

Small Business Insurance Market – Executive Summary

2.1 Market Revenue and Major Trends, and Challenges

Small Business Insurance Market – Comparative Analysis

3.1 Product Benchmarking

3.2 Financial Overview

3.3 Market Cost Divided

3.4 Estimating Examination

Small Business Insurance Market – Industry Market Entry Scenario

4.1 Governing Outline Summary

4.2 New Business index

4.3 Case Studies of Positive Schemes

Small Business Insurance Market Forces

5.1 Market Drivers

5.2 Market Restrains

5.3 Market New Opportunities

5.4 Market Challenges

5.4 Porters five force model

Small Business Insurance Market – Strategic Complete Overview

6.1 Value Chain Analysis

6.2 Market Opportunities Analysis

6.3 Market Challenges Analysis

6.4 Market Life Cycle

Small Business Insurance Market – By Regions (Market Size –USD Million)

7.1 North America

7.2 Europe

7.3 Asia-Pacific

7.4 The Middle East and Africa

7.5 Rest of the World

Continue...

Customization:

We also provide customized reports according to customers specific requirements. We also provide customization for regional and country-level reports individually.

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.